The latest trends in the retail sector

The retail sector is constantly changing. From pop-up stores and personalisation to sustainability and immersive experiences, retail trends reveal the direction in which brick-and-mortar retail is heading and the opportunities that are opening up for brands. We provide an overview of the most important developments and challenges of recent years, examine current trends, and offer insights into the future of the retail sector in Germany and around the world in 2026.

These were the trends of recent years

Pop-Up Stores

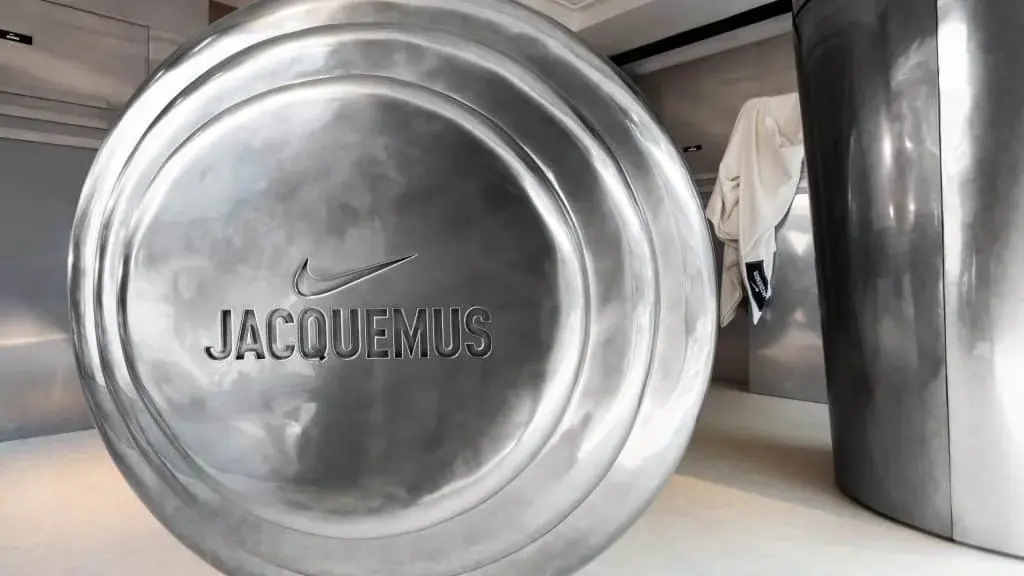

In 2024, pop-up stores once again demonstrated the flexibility and effectiveness of this format for brands. As well as filling unused retail space, they are particularly successful at creating surprising brand experiences and engaging customers in unexpected locations. Concepts that use pop-ups as experiential spaces are particularly successful – whether in urban areas, at festivals or in connection with events. One example of this was the collaboration between Nike and Jacquemus at Selfridges department store in London, where a temporary installation not only displayed items but also staged the brand itself as an experience.

Multi-brand concepts

Multi-brand formats have also become more important in recent years. The central challenge remains retail design: creating an atmosphere that is consistent, yet allows different brands to convey their individual brand identity. Multi-brand models aim to provide a platform that inspires customers and introduces them to new brand worlds. For example, in October 2024, a multi-brand store called Essx opened in New York City, bringing together different designer collections under one umbrella concept – providing a vibrant, stylishly designed fashion experience.

These are the retail trends for 2025

Sustainability and use of natural materials

Sustainability in retail means using responsible materials, energy-efficient design and durable, modular store concepts to reduce environmental impact throughout the store’s lifecycle.

By 2025, sustainability is increasingly evolving from a supplementary consideration into a foundational principle of retail strategy, encompassing material selection, store design and modularity. Retailers are focusing on reducing resource consumption, extending store lifecycles and improving environmental performance without compromising brand identity or customer experience.

According to a Retail Touchpoints magazine survey, 68% of store design teams now prioritise sustainability, compared to 36% in the previous year. In parallel, natural and bio-based materials are gaining relevance as visible indicators of sustainable commitment. IKEA, for example, is designing new city stores using recycled wood and energy-efficient lighting systems. Similarly, Aesop is opening stores worldwide that incorporate locally available materials such as natural stone and clay, reinforcing both environmental responsibility and local authenticity.

Digitalisation and integration of technology

In 2025, the fusion of physical retail and digital technology is developing into an increasingly important success factor. Retailers are focusing on several AI-supported applications at the point of sale (POS) to create a more seamless and personalised shopping experience:

- Interactive in-store technologies

Interactive displays, mobile self-checkout systems and smart shelving solutions are being deployed to better connect physical spaces with digital services and to simplify the customer journey. - AI-supported personalisation at the POS

Artificial intelligence enables personalised product recommendations directly in-store and supports customers through virtual assistants or digital stylists, enhancing guidance and decision-making at the shelf. - Real-time inventory optimisation

AI systems increasingly help optimise inventory levels in real time, improving product availability while reducing overstock and inefficiencies across the supply chain. - Use of first-party data for forecasting and services

A key component is the growing use of first-party data, which retailers are increasingly collecting and integrating into their supply chains to improve demand forecasts and customer services.

Studies indicate that many consumers perceive AI-supported services as added value, as they contribute to more personalised and efficient shopping experiences. For example, 68% of consumers report positive perceptions of AI-enabled services (IBM Global AI Adoption Index 2024).

A practical example is the French cosmetics retailer Sephora, which offers AI-supported skin analyses in its stores, combined with personalised email services and social media integration, illustrating how digital and physical touchpoints can be meaningfully connected.

Personalisation

LEGO is taking personalisation in physical retail to a new level in 2025: its stores now feature ‘Personalisation Studios’ where customers can design their own Lego minifigures – a creative experience that connects the brand and buyers on a personal level and exemplifies the new role of consumers who actively participate in the brand world.

Experience orientation

In 2025, brick-and-mortar retail will be more than ever about special brand and shopping experiences. Customers will come not only to buy products, but also to be inspired and try new things. Brands are therefore staging their retail spaces as experiential areas with interactive zones, events and workshops that go beyond pure shopping. Flexibility and organisation are crucial here, so spaces can be adapted for different concepts. Eataly is one example of this, combining eating, cooking and shopping in one place.

Mobile Pop-Up Stores

While classic pop-up stores were mainly used as temporary experience areas in city centres or department stores in 2024, they are gaining momentum in 2025. Mobile pop-up stores – whether converted containers, modular store concepts or trucks – bring brands directly to where their target groups are: at festivals, trade fairs, in residential areas or at sporting events. They create proximity, surprise and exclusivity without being tied to fixed locations. One example is the beauty brand Glossier, which tours several US cities with mobile pop-up trucks. Adidas also presents limited collections in mobile showrooms. Studies show that such formats significantly increase attention and interaction, particularly among younger target groups, as they offer a combination of experience, flexibility, and a sense of community.

These are the retail trends for 2026

Instore Retail Media

A central trend in 2026 is retail media - it will have evolved from digital platforms to brick-and-mortar stores.

The main benefits of in-store retail media are:

- New advertising revenue: Physical retail spaces become monetisable media inventory for brand partners.

- Direct customer engagement at the POS: Digital content reaches customers at the moment of purchase decision.

- Personalised communication: Data- and sensor-based systems enable relevant, targeted content.

- Measurable campaign performance: Campaign impact can be tracked and evaluated using clear metrics.

- Enhanced retailer–brand collaboration: In-store media enables joint, integrated marketing activities.

Examples of this can mainly be found in food retail: Carrefour, for instance, which is already integrating digital retail media spaces across Europe, while Tesco uses in-store screens to run brand-specific campaigns in collaboration with partners such as Dunnhumby..

Immersive and changing worlds of experience

Building on the experience-oriented trend of 2025, by 2026 retailers are increasingly developing their spaces into regularly changing immersive experience worlds. Instead of remaining pure sales rooms, stores are transforming into stages that showcase brand worlds, tell stories and actively involve customers. The motto is: experience instead of transaction.

With changing themes – such as seasonal displays, art or gaming installations – retailers create reasons for repeat visits. The Nike House of Innovation is an example of how interactive zones and changing experiences promote customer loyalty. For 2026, trends such as immersive experiential environments are expected, as a PwC study indicates that more than two thirds of consumers already visit brick-and-mortar retail specifically because of this perceived “added value.” By 2026, stores will become even more of an experience space, where community, entertainment and brand storytelling are more important than the mere act of purchasing. Instead of remaining pure sales spaces, stores are transforming into stages that tell stories and appeal to Gen Z as well as older generations.

AI-driven planning, digital twins and new technologies

By 2026, artificial intelligence will have become an even more central part of the retail sector – so much so that it will effectively be its driving force. Analyses by the Zukunftsinstitut emphasise that these developments will bring about not only technical but also cultural changes in consumer behaviour. AI will no longer just support individualisation and product range planning, but will control entire processes: from digital twin technology, which simulates stores in real time and makes planning more efficient, to autonomous stores where customers can shop without a checkout thanks to sensor technology and artificial intelligence. This is complemented by multisensory concepts that create immersive worlds through light, sound or scent, as well as robots that are used for both logistics and artistic productions. Examples range from Amazon Go with autonomous store concepts to MediaMarktSaturn, which is testing digital twins for space planning.

Sustainable design and colour concepts

- Modular, durable furnishing systems: Sustainable store concepts increasingly rely on modular and long-lasting furnishing systems that enable reuse, reduce material waste, and support flexible store layouts across multiple life cycles.

- Natural colour concepts: Earth tones, soft greens, and light wood shades are used to convey naturalness and consistency. Research from the field of colour psychology and biophilic design shows that natural colour palettes positively influence perceived store atmosphere and emotional response (e.g. findings summarised in studies on colour psychology and biophilic design).

- Positive effects on dwell time and purchase intention: Empirical studies on retail and environmental psychology indicate that store colours affect customer well-being, dwell time, and willingness to buy. Research on colour psychology demonstrates that colour schemes can influence approach behaviour and purchasing intentions in retail environments.

Is the focus on digital and online automatically a trend for the future?

Even though online retail and digital channels are experiencing ever-increasing growth and people's shopping behaviour is changing, brick-and-mortar retail remains indispensable because it offers brand experiences that cannot be replaced online. Studies such as those conducted by EHI show that 57% of the online shops with the highest turnover also operate physical stores. Many of these offline stores have natural digital connections and components. Stretched screens, bar-type screens, long narrow screens, or whatever you want to call them, are becoming cheaper and therefore more attractive – not only for pilot projects, but also for series production. Data and tracking are the keywords here. Almost everything that is digital can be measured, and if it is also online, it can be done conveniently in the marketing office. Employees can view the performance of their product presentations in dashboards, allowing them to review their targets and adjust them if necessary. But physical retail scores points not only through technology, but also through individualisation and sustainability: Whether it's personalised services like at Asos, where customers can customise their shopping bags on site, or the use of organic materials for displays aHowever, physical retail scores points not only through technology, but also through individualisation and sustainability. This could be personalised services, such as the ability to customise shopping bags on site at Asos, or the use of organic materials for displays and packaging. Stores are evolving into places where experience, individualisation and responsible behaviour converge. This is precisely where the strength of offline channels lies in comparison to e-commerce in 2025 and beyond.

Which industries and companies are trendsetters?

Trend leadership in retail cannot be limited to individual sectors and is influenced by many external factors. Innovations are being driven forward in the areas of fashion and beauty as well as lifestyle, DIY and consumer goods. In the fashion and cosmetics industry, many brands rely on digital pre-testing: products are first presented virtually, evaluated in communities and only produced if there is sufficient demand. This results in tailor-made offerings at reasonable prices with reduced risk. Lego successfully employs this approach in its community-driven product development. The company lets its customers make suggestions and then produces the model with the most votes. It's a win-win situation for both the customer and the company: the customer gets to decide what they want, and Lego gets to produce it.

New ideas are also emerging in the DIY and hardware store sector. Technologies such as Lift & Learn intuitively explain the differences between products to customers directly on the shelf, while at the same time providing retailers with valuable data on purchasing behaviour. This combines experience, knowledge transfer and digital evaluation. The key is to always actively involve customers and make them feel part of the brand and its development – a recipe for success that sets standards across industries.

Not all trends are suitable for all companies or customers

Not every trend can be applied to every target group. The benefit should always be at the main focus. It is worth asking the following question: What value does this development or technology offer me as a brand or my customers? The added value for your target group is crucial. Only then will consumers accept it. Give your target group time to get used to your new concept. Don't make hasty decisions, develop mature, well-thought-out solutions instead. Seek advice from studies, retail agencies and shopfitters who already have experience in this area and are developing solutions for the future. From time to time, it also helps to conduct a new target group analysis and review. Is my target group still the same or has it changed? What motivates them? Use these opportunities to prepare optimally not only for 2025, but also for the years beyond.

Frequently asked questions about retail trends

How can retailers ensure that new retail trends such as personalisation or digitalisation really create added value for their customers?

Added value only arises when trends are not used for their own sake. Retailers should ask themselves: ‘Does this tool really help my customers shop faster, easier or more inspiringly?’ Feedback, testing and customer data are all key factors here. For example, digital tools such as Lift & Learn or AI-supported recommendations only work if they simplify the shopping experience and do not complicate it unnecessarily. It is therefore crucial to use trends in a targeted manner to create real benefits for the target group.

How can retailers use their retail space flexibly to respond to new trends and target groups?

Flexibility is key: modular furniture, variable shelving systems and mobile displays enable retailers to quickly adapt their sales areas. This makes it easy to implement seasonal themes, events or changing brand worlds. It is important to plan the room layout well so that walkways, lighting and presentation elements always provide clear orientation for customers, even when changes are made.

How does ARNO support companies in implementing current retail trends such as experiential worlds, in-store media and sustainable concepts in practice?

ARNO translates current retail trends into concrete shopfitting solutions: we create worlds of experience through modular store concepts, interactive zones and digital elements such as Lift & Learn or integrated screens. In the area of in-store retail media, we develop displays and surfaces that can be seamlessly used as communication channels, for example through personalised content at the point of sale. When it comes to sustainable concepts, we rely on durable materials, efficient manufacturing processes, and flexible, modular systems. This ensures that your store looks modern and functions effectively in the long term.